Students can refer to Logistics and Insurance ICSE Class 10 notes and exam questions provided for ICSE students. This is an important chapter in ICSE commercial studies class 9. We have provided here questions and answers which are expected to come in the upcoming ICSE exams for class 10th. Prepared based on the latest examination pattern and guidelines issued by ICSE. You can also refer to ICSE Books in pdf available for the latest academic session.

ICSE Class 10 Commercial Studies Logistics and Insurance Important Questions

Students should learn the important questions and answers given below for Chapter Definitions From Topo Maps in Commercial Studies for ICSE Class 10. These board questions are expected to come in the upcoming exams. Students of ICSE Class 10th should go through the Important questions and answers ICSE Class 10 Commercial Studies which will help them to get more marks in exams.

Board Exam Questions Logistics and Insurance ICSE Class 10 Commercial Studies

Question: Define the term ‘logistics’.

Ans. Logistics is the process of managing the movement and storage of raw materials, parts and finished products from the supplier through the firm and on to customers. It includes all the activities that faciliate the flow of product from the source of raw materials to the point of final consumption Logistics is also known as Physical Distribution Management (PDM).

Question: Under what conditions water transport is suitable?

Ans. (i) For carrying huge quantity of bulky and heavy goods

(ii) For low cost transportation

(iii) For transporting goods across the seas

(iv) For safe carrying of goods

(v) For flexibility of transport

Question: Compare the merits of Road Ways and Railways.

Ans.

Question: State two disadvantage of water transport.

Ans. Two disadvantage of water transport are as follows :

(i) Slow speed : Water transport is relatively slow. The speed of vessels is limited and, therefore, water transport is not suitable for goods requiring quick delivery over short distances.

(ii) Limited area of operation : Water transport provide services to limited areas. Goods have to be brought to the ports and special packing is necessary. Services are available only between the terminal points.

Question: Mention any two documents used in warehousing.

Ans. Two documents used in warehousing are as follows :

1) Warehouse warrant 2) Delivery order

Question: What is Shipping?

Ans. Shipping or ocean transport has been divided into two categories, namely

(i) Coastal shipping, and (ii) Overseas shipping. Coastal shipping involves the carrying of goods from one port to another in the same country. Overseas shipping is done through liners, tramps and oil tankers to carry goods from one country to another over high seas.

Question: Define fire insurance.

Ans. Fire insurance is a contract under which the insurance company (insurer) agrees to idemnify the insured, in return for the premium, against damage or loss to property caused by fire during an agreed period of time and up to a specified amount. A fire insurance policy provides protection against damage or loss to property, i.e. building furniture, goods, etc. caused by fire

Question: Explain the following principles of an insurance contract:

(a) Utmost good faith.

(b) Subrogation.

Ans. (a) Utmost good faith (Uberrimae fidei) : An insurance contract is based on utmost good faith on the part of both the parties. It is the legal duty of the proposer (one who wants to get an insurance policy) to disclose all the material facts about the subject to be insured. A material fact is one which would affect the judgement of the insurer in assessing the degree of risk. It includes any communication made to or any information received by die proposer.

The insurer has no access to the information which is in the possession of the insured. Therefore, the insurer relies on the information provided by the proposer. The amount of premium is fixed on the basis of the information supplied by the proposer. The insurer has no access to the information which is in the possession of the insured. Therefore, the insurer relies on the information provided by the proposer. If the proposer cancels or withhelds any material facts, the insurer can repudiate the contract of insurance. Thus, good faith requires each party to disclose all the information at his command to the other party.

One party cannot induce the other party, by hiding material facts, to enter into a contract of insurance which is disadvantageous to the other party. If a party fails to disclose any material fact within his knowledge, the other party can avoid the contract on grounds of material misrepresentation.

(b) Doctrine of subrogation : It implies that after indemnifying the insured for his loss, the insurer becomes entitled to all the rights and remedies relating to the property insured. The insure shall step into the shoes of the insired, For example, X insures his house against fire for Rs. 50,000. The house is put on fire by his neighbour Y. X gets a claim of

Rs 50,000 from Rs 30,000 from Y. X will have to return Rs. 30,000 to the insurance company. Doctrine of subrogation is applicable to all contracts of indemnity and it is not applicable to life insurance. Insurer’s right of subrogation will extend only to the extent of the sum insured. The insurer can recover only what the insured

Question: Under what conditions Railway Transport is most suitable?

Ans. Railway transport is most suitable under the following conditions.

(i) For carrying goods and people over long distances

(ii) For transporting bulky and durable goods

(iii) For transportation in plains

(iv) When speed and cost of transportation are important

(v) For safe transportation of goods.

Question: Name any eight types of insurance.

Ans. (i) Life Insurance (ii) Fire Insurance

(iii) Marine Insurance (iv) Motor Vehicles Insurance

(v) Fidelity Insurance (vi) Burglary Insurance

(vii) Crop Insurance (viii) Social Insurance

Question: Explain the advantages and limitations of water transport.

Ans. Advantages of water transport are as follows :

(i) Low cost: Water transport is the cheapest and oldest mode of transport. Rivers and oceans are natural tracks and no capital investment is required for their construction and maintenance. The cost of fuel is low due to the force of water and smooth surface of the sea.

(ii) Large capacity : A ship has a large carrying capacity and, therefore, water transport is extremely suitable for heavy cargo. Bulky and heavy goods like coal, iron ore, timber, etc., can be carried over long distances. Economies of scale can be secured.

(iii) Suitability : In water transport, fragile goods like glassware can be carried without much risk of damage because of natural flow and slow speed. There is not much of shaking and jolting.

Limitations of water transport are as follows :

(i) Slow speed : Water transport is relatively slow. The speed of vessels is limited and, therefore, water transport is not suitable for goods requiring quick delivery over short distances.

(ii) Limited area of operation : Water transport provide services to limited areas. Goods have to be brought to the ports and special packing is necessary. Services are available only between the terminal points.

(iii) Unreliable : Water transport is unreliable. Waterways may not be navigable due to several reasons. During winter, rivers and canals may get frozen and during summer water may not be sufficiently deep. Water transport has seasonal character.

Question: What is meant by non-insurable risk? Give one example.

Ans. Any risk which cannot be insured against is a non-insurable risk. For example, risk of loss in speculation is a non-insurable risk.

Question: Describe the need of transportation?

Ans. Transportation is essential in all spheres of modern life. It is very important in industrial and commercial activities. The economic and social significance of transportation are described below.

(i) Efficient transportation reduces the costs of production and distribution and thereby the selling price of a product. Lower price encourages mass consumption.

(ii) Transportation helps to reduce price inequalities between different regions through proper adjustment of supply and demand. Equalisation and stabilisation of prices increases consumer’s surplus.

(iii) Transportation makes available goods produced in different countries, thereby increasing variety in consumption. In fact, the means of transport exercise a significant influence on the mode of consumption and the quality of consumer products. Transportation helps to improve the standard of living of the masses through more and diversified consumption.

(iv) Transportation is required at every step in the process of production and distribution. Raw materials and machinery have to be moved from the source of supply to the centre of production. Finished goods must be carried to the centres of consumption or markets.

(v) The level and speed of industrialisation in a country is determined to a great extent by the means of transportation. Transportation makes mass production possible as goods are produced for distant markets and the scale of output need not be restricted to local needs.

Question: What is transportation?

Ans. Transportation refers to the physical movement of goods and persons from one place to another. Its consists of all means by which goods are carried from the place of production to the place of consumption and whereby eople travel from one place to another. Transportation is an important human activity developed to over-come the distance barrier.

Question: Under what conditions air transport is most suitable?

Ans. (i) For most quick transportation

(ii) For carrying light, perishable and precious items

(iii) For transportation from one country to another

(iv) For transportation over long distances

(v) For safe and comfortable journey

Question: State any two features of air transport?

Ans. Air transport is the most modern means of transport. It is the fastest mode of transport that can carry people and goods from one country to another within a few hours.

Question: State the merits and demerits of water transport?

Ans. Merits of water transport are as follows :

(i) Low cost: Water transport is the cheapest and oldest mode of transport. Rivers and oceans are natural tracks and no capital investment is required for their construction and maintenance. The cost of fuel is low due to the force of water and smooth surface of the sea.

(ii) Large capacity : A ship has a large carrying capacity and, therefore, water transport is extremely suitable for heavy cargo. Bulky and heavy goods like coal, iron ore, timber, etc., can be carried over long distances. Economies of scale can be secured.

(iii) Suitability : In water transport, fragile goods like glassware can be carried without much risk of damage because of natural flow and slow speed. There is not much of shaking and jolting.

Demerits of water transport are as follows :

(i) Slow speed : Water transport is relatively slow. The speed of vessels is limited and, therefore, water transport is not suitable for goods requiring quick delivery over short distances.

(ii) Limited area of operation : Water transport provide services to limited areas. Goods have to be brought to the ports and special packing is necessary. Services are available only between the terminal points.

(iii) Unreliable : Water transport is unreliable. Waterways may not be navigable due to several reasons. During winter, rivers and canals may get frozen and during summer water may not be sufficiently deep. Water transport has seasonal character.

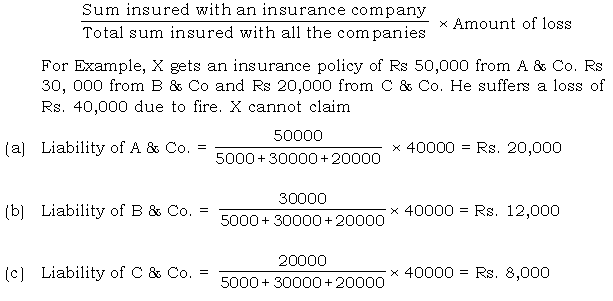

Question: Explain contribution as a principle of an insurance contract.

Ans. An insurance company which has paid the full claim of a policy to the insured has the right to get contribution from other insurance companies which have also insured the same loss. The contributions will in proportion to the amount insured by different companies.

Question: Describe the merits and limitations of Rail Transport?

Ans. Merits of rail transport are as follows :

(i) Larger capacity : Railways can carry a much larger quantity of goods than motor vehicles. More wagons can be added to handle larger volume of traffic. Therefore, railway transport is more suitable for carrying bulky and heavy goods.

(ii) Dependable : Railways are more reliable because they follow fixed routes, have regular time schedules and are available throughout the year. Rail transport remains relatively unaffected by rains, floods, fog, etc.

(iii) Safety : Railways are a safer mode of transport. Goods are protected from sun, rain, snow, etc. There are also fewer breakdowns and accidents.

Limitations of rail transport are as follows :

(i) Huge capital outlay : Huge capital investment is required for the construction of a railway system. Railway tracks have to be laid out, railway stations need to be constructed and railway wagons and other equipment have to be manufactured. This is beyond the capacity of an individual investor.

(ii) Inflexibility : Railways follow fixed routes and time schedules. No adjustments are made to suit the needs and convenience of individual users. A railway network is limited to the particular area in which the tracks have been laid and its services are available only between certain definite points. Goods have to be brought to and carried from the railway station. Door-to-door service is not possible.

(iii) Expensive : Maintenance and other operating costs of railways are very high. Terminal loading and unloading of goods involves extra expenditure and wastage. Therefore, railway transport is not suitable for short-distance traffic of goods.

Question: State any two disadvantages of Rail Transport

Ans. Two disadvantages of rail transport are as follows.

(i) Rail transport does not offer door-to-door service.

(ii) Rail transport is costly and involves formalities.

Question: Explain :

(i) Fire Insurance

(ii) Marine Insurance

(iii) Health Insurance

Ans. (i) Fire Insurance : Fire insurance may be defined as a contract in writing whereby the insurance company in consideration of a sum of money (called premium) undertakes to indemnify the insured (owner of the property) for any loss or damage to the insured property or goods caused by accidental fire. A fire insurance policy is generally for one year. Fire insurance policy provides protection against loss or damage by fire. Fire insurance is a contract of indemnity. The insured is compensated for the loss he has actually suffered (subject to the maximum amount insured) on account of destruction of property by fire.

(ii) Marine Insurance : Marine insurance is a contract of indemnity whereby the insurance company undertakes to indemnify the insured for the loss or freight on account of marine adventure. It is a contract under which the insurrer agrees to compensate the insured against risks indcidental to marine adventure. A policy of marine insurance may be taken out for a particular period or for a particular voyage.

(iii) Health Insurance : As the name suggests, health insurance means insurance for protection of health against various types of diseases. In case of ill health, the insured person receives the cost of treatment/ hospitalisation upto the insured amount. Mediclaim is the most popular health insurance policy. Under this policey, the insured person gets cashless facility from the specified hospitals. The cost of treatment (upto 5 lacs) in the hospital is directly paid for by the insurance company to the hospital. Health insurance also covers loss of income from sickness in addition to medical expenses.

Question: Discuss the merits and demerits of air transport.

Ans. Merits of air transport are as follows :

(i) Shortest route : An aeroplane adopts the most direct and shortest route. It can fly over deserts, high seas, forests and mountains. Its movement is not hindered by geographical barriers. It can also reach places inaccessible by other means of transport.

(ii) Highest speed : The outstanding advantage of air transport is its speed. It is by far the fastest mode of transport. Therefore, air transport is best suited for perishable and other goods requiring immediate or prompt delivery. It also saves valuable time for busy businessmen and high officials.

(iii) Efficient service : Air transport provides regular and efficient service. It follows fixed time schedules. During emergencies, deviation from normal route can be made.

Demerits of air transport are as follows :

(i) Costly : Air transport is the costliest mode of transport. The cost of operation and maintenance of aerodromes and aeroplanes is very high. Therefore, air transport is suitable only for goods which are of high value in relation to their bulk and weight.

(ii) Limited capacity : The load-bearing capacity of an aeroplane is limited. Therefore, it is not suitable for carrying bulky and heavy goods.

(iii) Risky : Risk of accidents and plane crash is high in .air transport. Even a slight mechanical barrier or bird-hit may destroy a plane with all the passengers and cargo on board.

Question: How is air transport superior to water transport ?

Ans. (i) Cost of Service : Ocean transport is the cheapest for carrying heavy and bulky goods across the sea. But the speed is very slow and this facility is available only between certain points. Air transport is the costliest. It is, therefore, suitable only for goods which are highly valuable or are urgently required.

(ii) Speed of transport : Air transport is the quickest because planes fly at high speed and take the shortest route. Aeroplanes can provide unbroken journey-over oceans, high mountains and dense forests. Ocean transport is the slowest and is, therefore, unsuitable for perishable goods. The above description makes it clear that each mode of transport is suitable only for a particular type of goods. Air transport is suitable for light and precious articles which are to be delivered quickly. Ocean transport is appropriate for carrying heavy and bulky goods over long distances at the cheapest possible cost.

Question: Discuss the essential features of an ideal warehousing.

OR

Explain the essential characteristics of goods storage facilities.

Ans. Essential features / characteristics of an Ideal Warehouse :

(i) Proper location : An ideal warehouse should be located in such a place where buyer and sellers of goods can reach conveniently and economically. It must be centrally located so that loading, unloading and transportation of goods takes minimum time and cost.

(ii) Adequate space : In an ideal warehouse sufficient space should be available so that maximum amount of goods may be stored.

(iii) Suitability : An ideal warehouse should be suitable for the commodity to be stored. For example, a cold storage is suitable for perishable goods, whereas a fire proof warehouse is required for inflammable goods.

(iv) Proper safety : Goods should be protected from heat, cold, water, insects, corrosion, fire, etc. An adequate protection must also be provided against pilferage and theft of goods.

(v) Low cost : The cost of operating and maintaining the warehouse should be reasonably low. The benefits must be more than the cost.

Question: State two advantages of Road transport over Air Transport. .

Ans. Two advantages of road transport over air transport are .

(i) Road transport is cheaper than air transport.

(ii) Road transport offers door-to-door service which is not possible in case of air transport.

Question: What is bonded warehouse? Discuss its advantages to importers.

Ans. A bonded warehouse is established under a bond with the customs authorities for storage of dutiable goods till the payment of imports duty. The owner of a bonded warehouse gives on undertaking not to release the goods until the customs duty is paid. Bonded warehouses are located in port towns and are licensed by the government. These warehouses operate under the vigilance of customs officials. Bonded warehouses accept imported goods for storage before the payment of customs duty. Once the duty is paid, goods are released on the authority of a warrant issued by the customs authorities.

Bonded warehouses offer the following advantages to importers :

(i) Importers can keep the imported goods in bonded warehouses. They can make payment of customs duty in instalments and withdraw the goods in small quantities. Importers need not lock up a large amount of working capital for payment of imports duty at a time.

(ii) Importers who do not have their own warehouses can keep their goods by paying nominal charges. They need not take away all the imported goods at once from the port town. Safety of goods is assured.

(iii) Importers can regulate supply of goods according to demand by storing them in bonded warehouses. If all the imported goods are put to market for sale at once, there may be a heavy fall in prices and the importer may suffer a huge loss.

(iv) Goods imported for the purpose of re-export can be kept in bonded warehouses. The importer can thereby save transport costs of removing them to his godown and again bring them to the port. He need not pay import duty and later claim refund.

(v) Goods which are imported for re-export can be stored in bonded warehouses, thereby saving costs of transportation. The importer can perform blending, grading and repacking processes in bonded warehouses. As a result, importers can re-export goods at a lower price and face competition in international market. In this way, bonded warehouses encourage re-exports.

Question: Describe the commodities for which air transport is most suitable.

Ans. Air transport is most suitable for commodities like flowers, eggs, vegetables, furits, medicines, Jewellery etc.

Question: Name four kinds of warehouses and explain each of them.

Ans. (i) Private Warehouses : These warehouses are owned by manufacturers and traders to store the goods produced or purchased by them until they are sold out. Manufacturers need their own warehouses to store goods in anticipation of demand. Wholesalers also require their own storage facilities to maintain large stocks of goods for sale to retailers.

The expenses of constructing, maintenance and insurance of private warehouses are paid for the their owners.

(ii) Public Warehouses : These warehouses are meant for use by businessmen in general. Any businessman can store his goods in these warehouses for some charge. Public warehouses may be owned by Government, public trusts and other public authorities. The owner of a public warehouse serves as an agent to the owner of the goods.

(iii) Bonded Warehouses : A bonded warehouse is established under a bond with the customs authorities for storage of dutiable goods till the payment of imports duty. The owner of a bonded warehouse gives on undertaking not to release the goods until the customs duty is paid. Bonded warehouses are located in port towns and are licensed by the government.

(iv) Cold storages (Refrigerated Warehouses) : These warehouses are constructed for storage of perishable goods such af vegetables, fruits, milk products, fish, eggs, etc. Cold storages, are very useful to farmers, traders and consumers.

Question: Explain the utility of cold storage.

Ans. Cold storage warehouses are constructed for storage of perishable goods such as vegetables, fruits, milk products, fish, eggs, etc. Cold storages, are very useful to farmers, traders and consumers.

They offer the following utility :

(i) Cold storage prevents wastage of perishable commodities. If products like vegetables, fruits, eggs, meat, etc., are not kept in cold storage, they will become rotten and unfit for consumption,

(ii) Cold storage enables farmers to obtain remunerative prices for agricultural produce and thereby save them from financial loss. In the absence of cold storage, famers will be forced to sell their perishable goods at throw-away prices.

(iii) Cold storage make seasonal products available to consumers throughout the year,

(iv) Cold storage helps to reduce price fluctuations. In the absence of cold storage perishable goods will be available at very low prices in some season and at very high prices in other seasons.

(v) Cold storage facilitates exports of perishable goods and thereby earn foreign exchange. India exports mango, lady finger, onion etc. to several countries.

Question: What is meant by insurance? Explain the fundamental principles of insurance.

or

Explain any five principles of insurance.

Ans. “Insurance is a contract in which a sum of money is paid by the assured in consideration of insures incurring the risks of paying a large sum upon a given contingency.” – Justice Tindal

Five principles of insurance.

(i) Utmost good faith (uberrimae fidei): As contrast of insurance is based on mutual trust and confidence. It means that each party to the insurance contract must disclose all the information which is likely to influence the other party’s decision to enter into contract. The proposer knows better the facts relating to the risk. Therefore, he must disclose all material facts known to him.

(ii) Insurable interest : A person must have interest in the non – occurrence of the event being insured. He should stand in a position that he would benefit from the existence of the subject matter and would suffer a loss from its destruction or damage.

(iii) Indeminity : Indemnity implies compensation. According to this principle, the insurer shall compensate the insured in case of a loss against which the policy was issued. The purpose is to place the insured financially in the same position in which he was before the loss.

(iv) Subrogation : This principle is a corollary to the principle of indemnity. According to the principle of subrogation, the insurer becomes owner of the damaged property after compensating the insured for loss. For example, a person insures his car for Rs. 2,50,000. The car is badly damaged in an accident. The insurance company pays Rs 2,50,000 to the insured. The damaged car which is worth Rs. 500,000 becomes the property of the insurance company.

v) Contribution : This is also a corollary to the principle of indemnity. According to the principle of contribution, If a person gets the same property insured with two or more insurers, all the insurers will contribute to the compensation to be paid to the insured. The insurance companies will pay in proportion to the sums insured with them.

Question: What is bonded warehouse?

Ans. A bonded warehouse is established under a bond with the customs authorities for storage of dutiable goods till the payment of imports duty. The owner of a bonded warehouse gives on undertaking not to release the goods until the customs duty is paid. Bonded warehouses are located in port towns and are licensed by the government.

Question: Discuss the advantages of insurance to businessmen and to the public.

Ans. Advantages to businessmen – Insurance is of paramount importance to business because business operates in the midst of uncertainties and risks of several types. Some of the benefits of insurance to businessmen are given below :

(i) Protection against risk : Business is full of risks. Many of the business risks can be covered through insurance. In the absence of insurance, a business may be completely wiped out by a sudden loss.

(ii) Increase in business efficiency : Insurance removes uncertainly and relieves the businessmen of mental tension. They are encouraged to work hard and improve the efficiency of business operations. Insurance helps in exension of business by providing a sense of security.

(iii) Financial assistance : Insurance increases the capacity of business to borrow. A businessman can raise loan by pledging life insurance policy as collateral security. Moreover, redeemable debentures can be issued on the collateral security of capital redemption policies.

Advantages to public – Insurance offers the following benifits to the public

(i) Protection : Insurance provides protection against several types of risks. Life insurance provides, financial assistance to family in the untimely death of the policyholder.

(ii) Savings : Life insurance encourages the habit of thrift and savings after taking an insurance policy, a person saves money to pay regular premium. On the maturity of the life policy, the insured receives a lump sum amount. This amount can be utilised for higher education/ marriage of children or construction of a residential house. Thus, life insurance serves, as a means of protection as well as a means of savings.

(iii) Financial aid : In case of financial need the policy holder can take a loan against the policy. The loan can be repaid in easy instalments.

Question: State any five advantages of Road Transport over Water Transport.

Ans. (i) Road transport is more flexible than Water transport because roads

are everywhere while sea and rivers are available at few places.

(ii) Road transport provides door-to-door service which is not available in case of water transport.

(iii) Road transport is faster than water transport.

(iv) Road transport can reach hilly and rocky areas which is not possible in case of water transport.

(v) Road transport provides a more personalised and hassle free service than water transport.

Question: Explain the benefits of taking an insurance policy.

Ans. The benefits of taking an insurance policy are given below :

(i) Protection against risk : Business is full of risks. Many of the business risks can be covered through insurance. In the absence of insurance, a business may be completely wiped out by a sudden loss.

(ii) Increase in business efficiency : Insurance removes uncertainty and relieves the business of mental tension. They are encouraged to work hard and improve the effieiency of business operations. Insurance helps in expansion of businessmen of mental tension. They are encouraged to work hard and improve the efficiency of business operations. Insurance helps in expansion of business by providing a sense of security.

(iii) Financial assistance : Insurance increases the capacity of busines to borrow. A businessman can raise loan by pledging life insurance policy as collateral security. Moreover, redeemable life insurance policy as collateral security. Moreover, redeemable debentures can be issued on the collateral security of capital redemption policies.

(iv) Insurance of key employees : Key employees are those employees whose absence or incapacity will cause a tremendous reduction in the income of business. The survival and growth of business depends on such employees They are the most valuable asset of a business. Life policies can be taken to protect against the loss arising out of the death, disability, etc., of key executives.

(v) Continuity of operations : Insurance policies provide adequate fund, in the event of loss so that a business may be rebuilt and carried on without much interruption or delay. Insurance ensures stability of business.

We hope you like the above provided Logistics and Insurance ICSE Class 10 notes and questions with solutions. In case you are searching for more study material then you can send us your comments in the box below. Our team of ICSE teachers will work to provide you the ICSE study material for free.